If you’re facing foreclosure in Tulsa, you’re likely feeling overwhelmed. You’re unsure about your next steps. The good news is that you have options. You can turn to professionals like Sell My House Fast Tulsa for guidance and support.

Located at 7122 S Sheridan Rd, Ste 2-1018, Tulsa, OK 74133-2748, they can be reached at 918-200-9185 for immediate assistance. With their help, you can navigate the complex process of selling your home during foreclosure.

This guide will walk you through the process. It will provide you with the foreclosure help for selling your house that you need. By understanding your options, you can make informed decisions about your future.

Key Takeaways

- Understand the foreclosure process in Tulsa and your options for selling your home.

- Learn how to work with companies like Sell My House Fast Tulsa for a quick sale.

- Get insights into the benefits of selling your house during foreclosure.

- Discover how to avoid common pitfalls in the foreclosure sales process.

- Find out how to get immediate assistance for your foreclosure needs.

Understanding Foreclosure in Tulsa: What You Need to Know

Facing foreclosure in Tulsa can be scary, but knowing the process is key. As a homeowner, it’s vital to understand the foreclosure process. This knowledge helps you make smart decisions about your property.

The Oklahoma Foreclosure Process Timeline

The foreclosure process in Oklahoma starts when a homeowner misses mortgage payments. This leads to a loan default. The lender then sends a notice of default, beginning the pre-foreclosure period.

Pre-foreclosure Notice Requirements

In Oklahoma, lenders must give homeowners a pre-foreclosure notice. This notice includes details about the default and how to cure it. It’s sent by certified mail and posted on the property.

Judicial vs. Non-judicial Foreclosure in Oklahoma

Oklahoma has both judicial and non-judicial foreclosures. Judicial foreclosure involves a court, with a judge overseeing the process. Non-judicial foreclosure happens without court help, following the mortgage contract’s power of sale clause.

Legal Rights of Homeowners Facing Foreclosure in Tulsa

Homeowners in Tulsa have legal rights during foreclosure. These include the right to receive proper notice and the right to cure the default. They also have the right to contest foreclosure in court if needed. Knowing these rights is essential for effectively navigating the foreclosure process.

The Oklahoma Bar Association says, “Homeowners facing foreclosure should know their rights and options to avoid losing their homes.” Understanding your rights can help you look into alternatives like loan modification, short sales, or deed in lieu of foreclosure. These options can lessen the foreclosure’s financial impact.

Signs You Should Consider Selling Your House in Foreclosure

Deciding to sell a house in foreclosure is tough. But, some signs show it’s the right choice. You need to check your finances and your property’s condition before making a decision.

Financial Warning Signs

Struggling to pay your mortgage is a big sign you need to act. Other signs include:

- High-interest rates on your mortgage that are hard to handle.

- A big drop in your income or a rise in expenses.

- Growing debt from late fees and penalties on your mortgage.

When Selling Makes More Sense Than Fighting Foreclosure

Selling your house might be better than fighting foreclosure in some cases. This choice depends on your property’s equity and the foreclosure timeline.

Equity Considerations

Having a lot of equity in your home can help. Selling might let you pay off your mortgage and keep some money. Here’s a table to help you see how equity affects your choice:

| Equity Status | Potential Outcome |

| Positive Equity | You can sell your house, pay off the mortgage, and possibly keep some money. |

| Negative Equity | You might need to consider a short sale or face foreclosure, potentially leaving you with debt. |

Timeline Factors

The speed of the foreclosure process is key. If it’s moving fast, you must sell quickly. Knowing the Oklahoma foreclosure timeline helps you decide on time.For Tulsa homeowners facing foreclosure, getting foreclosure help for selling my house is vital. It guides you through the complex process and helps you make the best choice for your situation.

Options for Homeowners Facing Foreclosure in Tulsa

If you’re having trouble with mortgage payments in Tulsa, knowing your options can be a big help. Homeowners facing foreclosure have several choices, each with its own benefits and drawbacks.

Loan Modification and Forbearance

Loan modification changes your loan terms to make payments easier. This could mean a lower interest rate, a longer loan term, or a reduced principal balance. Forbearance, by contrast, temporarily lowers or pauses your mortgage payments, giving you a short-term break.

Short Sale vs. Foreclosure

A short sale lets you sell your house for less than what you owe on the mortgage, with the lender’s okay. It’s often better than foreclosure because it can hurt your credit score less. But, it might lead to tax issues.

Deed in Lieu of Foreclosure

A deed in lieu of foreclosure means you give the lender your property title, skipping the foreclosure process. This option can be gentler on your credit than foreclosure. Yet, it might also lead to tax problems.

Bankruptcy as a Last Resort

Bankruptcy can stop foreclosure temporarily, giving you time to look at other choices. But, it should be seen as a last resort because it can badly hurt your credit and future finances.

Knowing about these options and their effects can help you make a smart choice when facing foreclosure in Tulsa.

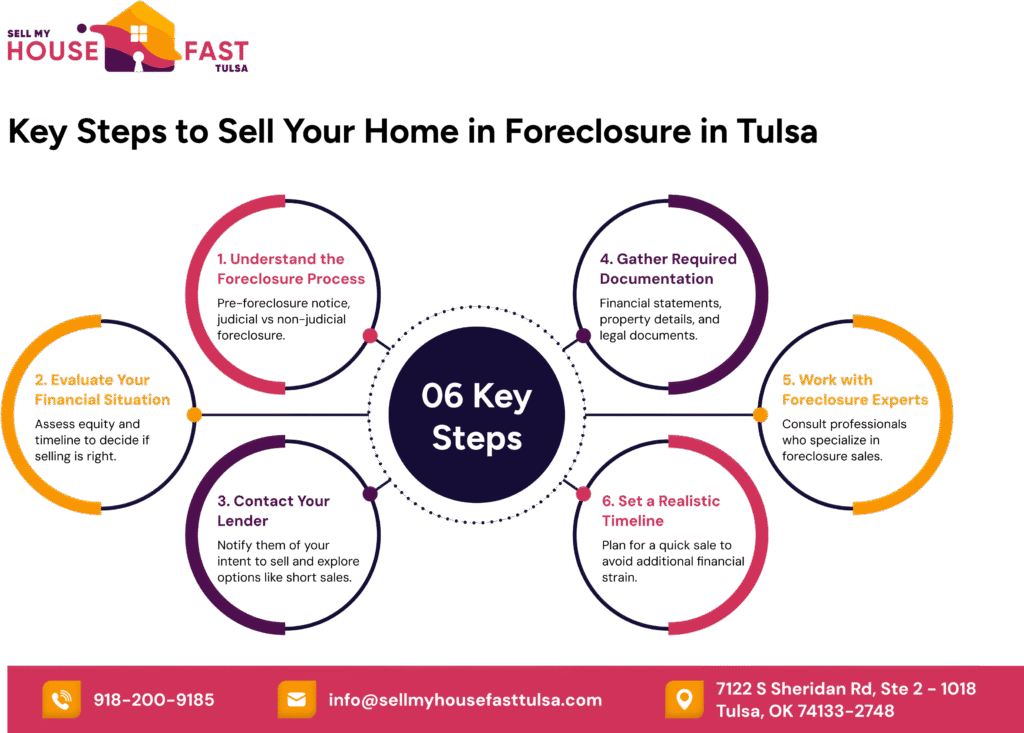

How to Sell My House in Foreclosure Tulsa: Step-by-Step Process

Selling a house in foreclosure in Tulsa has several key steps. Homeowners need to understand these to succeed. This guide will help you through the foreclosure process and sell your house successfully.

Contacting Your Lender About Your Intent to Sell

First, contact your lender about selling your house. This step is important. It might lead to options like a short sale or deed in lieu of foreclosure. Be ready to share your financial details.

Gathering Necessary Documentation

To sell your house, you’ll need certain documents. These include:

- Financial statements

- Property information

Financial Statements Required

You’ll need to show detailed financial statements. This includes income proof, expense reports, and more. This helps your lender understand your finances.

Property Information Needed

Collect all property details, like the deed and title report. Having this ready makes selling easier.

Setting a Realistic Timeline for Sale Completion

Setting a realistic timeline is key to a quick sale. Work with your lender and agent to plan a timeline. A good plan can avoid delays.

Working with Foreclosure Specialists in Tulsa

Consider professionals who know foreclosure sales well. They offer valuable advice and help with complex laws and lender negotiations.

By following these steps and getting help from experts, you can sell your house in foreclosure in Tulsa. Remember, acting fast and being prepared are key.

Traditional Home Sale vs. Cash Buyers for Foreclosure Properties

Homeowners in Tulsa with foreclosure options must weigh traditional sales against cash sales. Each choice has its pluses and minuses. Knowing these can help make a smart choice.

Pros and Cons of Listing with a Realtor During Foreclosure

Listing with a Realtor is an option, but it comes with challenges.

Timeline Challenges with Traditional Sales

Traditional sales take time. They involve listing, showing, and negotiating. For those facing foreclosure, delays can worsen financial issues.

Cost Considerations

Realtors charge 4-6% of the sale price in commissions. There are also costs for repairs and staging the property.

Benefits of Working with Cash Home Buyers in Tulsa

Cash buyers are a good option for homeowners in foreclosure.

Speed of Transaction

Cash sales are quick, often done in days. This is a big plus for those needing fast relief from foreclosure.

As-Is Purchase Options

Cash buyers buy properties as-is. This means no need for costly repairs or renovations before selling. It’s a big advantage for those without the funds for property prep.

| Aspect | Traditional Sale | Cash Sale |

| Timeline | Typically longer, involving listing and negotiation phases | Usually faster, often completed within days |

| Costs | Involves Realtor commissions (4-6%) and possible repair costs | No Realtor commissions; often “as-is” purchases |

| Condition of Property | May need repairs and staging to attract buyers | Properties are purchased “as-is,” no repairs needed |

Understanding the pros and cons helps Tulsa homeowners facing foreclosure make the best choice. Whether it’s a traditional sale or selling to cash buyers, the right decision depends on their situation.

Preparing Your Tulsa Home for a Quick Sale During Foreclosure

To sell your Tulsa home fast during foreclosure, follow a few key steps. You need to make it appealing to buyers and meet legal standards.

Essential Repairs and Improvements

Begin by fixing important issues that affect your home’s saleability. Fix leaky faucets, repair damaged floors, and tackle any structural problems. These fixes can attract more buyers.

Staging Tips for Fast Sales

Effective staging can also help sell your home quicker. Clear out clutter, arrange furniture to make rooms look bigger, and show off your home’s best features.

Disclosure Requirements for Foreclosure Properties

When selling a foreclosed home, it’s vital to follow disclosure rules. Be open about your home’s condition and any known problems to avoid legal issues.

Pricing Your Foreclosure Property Correctly in Tulsa’s Market

The Tulsa real estate market needs a smart plan for pricing foreclosure homes. When you want to sell my house in foreclosure Tulsa, knowing the market trends is key.

Current Tulsa Real Estate Market Trends

Tulsa’s real estate market changes often. Property values and demand can shift. To price your foreclosure right, keep up with the latest trends.

Neighborhood-Specific Considerations

Different Tulsa neighborhoods have their own prices. For example, areas with good schools and low crime rates cost more. Think about your neighborhood’s features when setting your price.

How Foreclosure Status Affects Property Value

A foreclosure can lower your property’s value. Buyers might see foreclosure homes as distressed. Knowing this helps set a fair price.

Competitive Pricing Strategies for Quick Sales

To sell fast, use competitive pricing. Look at similar Tulsa homes, understand local demand, and set a price that draws buyers. Looking into Tulsa house foreclosure options can help too.

By studying market trends, neighborhood details, and foreclosure effects, you can price your home well. This smart strategy helps sell your foreclosure home in Tulsa quickly and successfully.

Legal Considerations When Selling a House in Foreclosure

Selling a house in foreclosure is complex. Tulsa homeowners need to be careful. Knowing the legal aspects can help you make smart choices and avoid more financial trouble.

Oklahoma-Specific Foreclosure Laws

Oklahoma has its own foreclosure laws. Foreclosure here goes through the court. Homeowners get a notice of default and a pre-foreclosure notice. This gives them a chance to fix the issue or fight the foreclosure.

It’s key to know Oklahoma law requires lenders to give homeowners proper notice. Learning these laws helps you understand your rights and duties during foreclosure.

Working with Foreclosure Attorneys in Tulsa

Foreclosure laws are complex. Working with a skilled foreclosure attorney in Tulsa is a good idea. They can guide you, explain your options, and try to stop or slow down foreclosure.

Choose an attorney with Oklahoma foreclosure law experience. They should have a good track record helping homeowners like you.

Tax Implications of Selling During Foreclosure

Selling a house in foreclosure affects your taxes. It’s important to know this to avoid big tax bills. You need to think about debt forgiveness taxation and capital gains.

Potential for Debt Forgiveness Taxation

If you do a short sale or deed in lieu of foreclosure, your lender might forgive some debt. But, the IRS might see this as taxable income. Knowing the Mortgage Forgiveness Debt Relief Act and other tax laws is key.

Capital Gains Considerations

Even if you don’t have much capital gains, selling your home has tax implications. You might be able to get exemptions or deductions that lower your taxes.

Talking to a tax expert can help you understand your tax situation. They can help you plan for the future.

Negotiating with Lenders: Strategies for Success

Lender negotiations are key in the foreclosure process, helping Tulsa homeowners. Good negotiation can lead to benefits for both sides, possibly avoiding foreclosure. A recent quote highlights this:

“Negotiation is not just about reaching an agreement; it’s about building a solution that works for everyone involved.” – Unknown

How to Request a Postponement of Foreclosure Sale

Asking for a postponement of foreclosure sale can offer temporary relief. It gives homeowners time to look into options like selling their house quickly. To ask for a postponement, homeowners should talk to their lender. They should explain their situation and provide financial documents to back their request.

Negotiating Payoff Amounts and Deficiency Judgments

Negotiating the payoff amount and deficiency judgments is essential. Homeowners need to discuss their finances and possibly settle for less than the full amount owed. This step is complex but vital in minimizing financial loss during foreclosure.

Working with Loss Mitigation Departments

Loss mitigation departments in lenders aim to prevent foreclosure. By working with these departments, homeowners can look into alternatives like loan modifications or short sales. This could lead to a better outcome when trying to sell my house in foreclosure Tulsa.

Common Mistakes to Avoid When Selling a Foreclosure Property

Selling a house in foreclosure can be tricky. Homeowners in Tulsa often face several pitfalls. Knowing how to avoid these can save time and money.

Pricing Errors That Cost Homeowners

One big mistake is setting the wrong price. If you price too high, it takes longer to sell. If you price too low, you lose money. It’s key to understand the Tulsa real estate market to set a fair price.Market analysis should look at the property’s condition, similar sales, and how foreclosure affects value.

Timing Mistakes in the Foreclosure Sale Process

Timing is everything when selling a foreclosure. Waiting too long adds financial stress. Rushing without preparation can lead to bad deals.

Knowing the Oklahoma foreclosure process timeline helps plan a sale. This can help avoid extra costs.

Scams Targeting Foreclosure Homeowners in Tulsa

Scammers often target those facing foreclosure. They promise quick fixes or unrealistic solutions. It’s important to be aware of these scams to avoid losing money.

Warning Signs of Foreclosure Relief Scams

- Requests for upfront fees for services that seem too good to be true

- Pressure to make quick decisions without adequate information

- Lack of transparency about the process and possible outcomes

How to Report Fraudulent Activity

If you think you’re being scammed, report it. In Tulsa, contact the Tulsa Police Department or the Oklahoma Attorney General’s Office.

| Common Mistake | Consequence | Prevention Strategy |

| Pricing Errors | Longer sale process or financial loss | Conduct thorough market analysis |

| Timing Mistakes | Additional financial strain or unfavorable sale terms | Understand the foreclosure timeline and plan according |

| Falling Prey to Scams | Financial loss and possible legal issues | Be cautious of unsolicited offers and report suspicious activity |

Resources and Assistance for Tulsa Homeowners Facing Foreclosure

Facing foreclosure can feel overwhelming. But Tulsa residents have many resources to help. You can find counseling, government aid, or a quick sale to get through this tough time.

Local Housing Counseling Agencies

Tulsa homeowners can get free or low-cost advice from local agencies. These groups help you understand your options and negotiate with lenders. They also help you create a plan to avoid foreclosure.

Agencies approved by the U.S. Department of Housing and Urban Development (HUD) offer expert guidance. They are there to help.

Government Programs for Foreclosure Prevention

The government has programs to prevent foreclosure. These include loan modifications and forbearance agreements. Tulsa homeowners should check if they qualify for these options.

How Sell My House Fast Tulsa Can Help

If selling your house is the best choice, “Sell My House Fast Tulsa” can help. Our team buys foreclosure properties quickly. This way, you can skip the long selling process.

One of our clients said,

“They made the process so easy and stress-free; I was able to move on with my life quickly.”

Our Process for Buying Foreclosure Properties

We know how urgent foreclosure situations are. Our fast process ensures a quick sale, usually in a week. We handle all the paperwork, inspections, and negotiations.

Success Stories from Tulsa Homeowners

Many Tulsa homeowners have avoided foreclosure with our help. Our clients appreciate our professionalism, speed, and fairness. We’re proud to help homeowners start fresh.

Conclusion: Taking Control of Your Foreclosure Situation

You now know how foreclosure works in Tulsa and what you can do. Selling your house quickly can ease your financial worries. By following the steps we’ve shared, you can take charge and make a smart choice.

There are resources to help you sell your house in foreclosure. Local housing counseling agencies and government programs offer support. They can guide you through the foreclosure process and help you sell successfully.

To sell your house in foreclosure, work with experts who know the Tulsa market. Proper pricing and repairs can attract buyers. This way, you can sell your house efficiently.

Start solving your foreclosure problem by getting professional help and looking at your options. With the right advice and support, you can beat foreclosure and move on.

What are my options if I’m facing foreclosure in Tulsa?

You have several options. You can try loan modification, short sale, or deed in lieu of foreclosure. Bankruptcy is also an option. Selling your house to a cash buyer like Sell My House Fast Tulsa is another choice. They offer a quick and easy solution. Call them at 918-200-9185 or visit their office at 7122 S Sheridan Rd, Ste 2-1018, Tulsa, OK 74133-2748.

How long does the foreclosure process take in Oklahoma?

Foreclosure in Oklahoma usually takes 150-180 days. But, it can vary based on the lender and your situation. Knowing the timeline helps you plan your next steps, like selling your house or looking for other options.

Can I sell my house in foreclosure in Tulsa?

Yes, you can sell your house in foreclosure in Tulsa. Selling can help avoid foreclosure’s negative effects, like credit score damage. Companies like Sell My House Fast Tulsa buy houses in foreclosure and offer a quick sale.

What are the benefits of working with a cash home buyer during foreclosure?

Working with a cash home buyer has many benefits. You get a quick sale and can sell your house as-is. You also avoid realtor fees. Cash buyers like Sell My House Fast Tulsa can close the sale in days, which is a big relief for homeowners facing foreclosure.

How can I stop foreclosure on my Tulsa house?

There are ways to stop foreclosure. You can try loan modification, forbearance, or bankruptcy. Selling your house to a cash buyer or working with a foreclosure specialist are also options. Contact Sell My House Fast Tulsa at 918-200-9185 to discuss your situation and find a solution.

What are the tax implications of selling my house during foreclosure?

Selling your house during foreclosure has complex tax implications. It depends on your situation. You might face capital gains tax or debt forgiveness taxation. It’s important to talk to a tax professional to understand the tax implications and plan your sale.

Can I negotiate with my lender to stop foreclosure?

Yes, you can negotiate with your lender. You might ask for a postponement of the foreclosure sale or negotiate a payoff amount. It’s key to communicate with your lender and explore options to find a solution that works for you.

How can Sell My House Fast Tulsa help me with my foreclosure?

Sell My House Fast Tulsa specializes in buying houses in foreclosure. They offer a quick and hassle-free solution. They can help you avoid foreclosure’s negative effects and provide a fast sale. Contact them at 918-200-9185 to discuss your situation and find a solution.